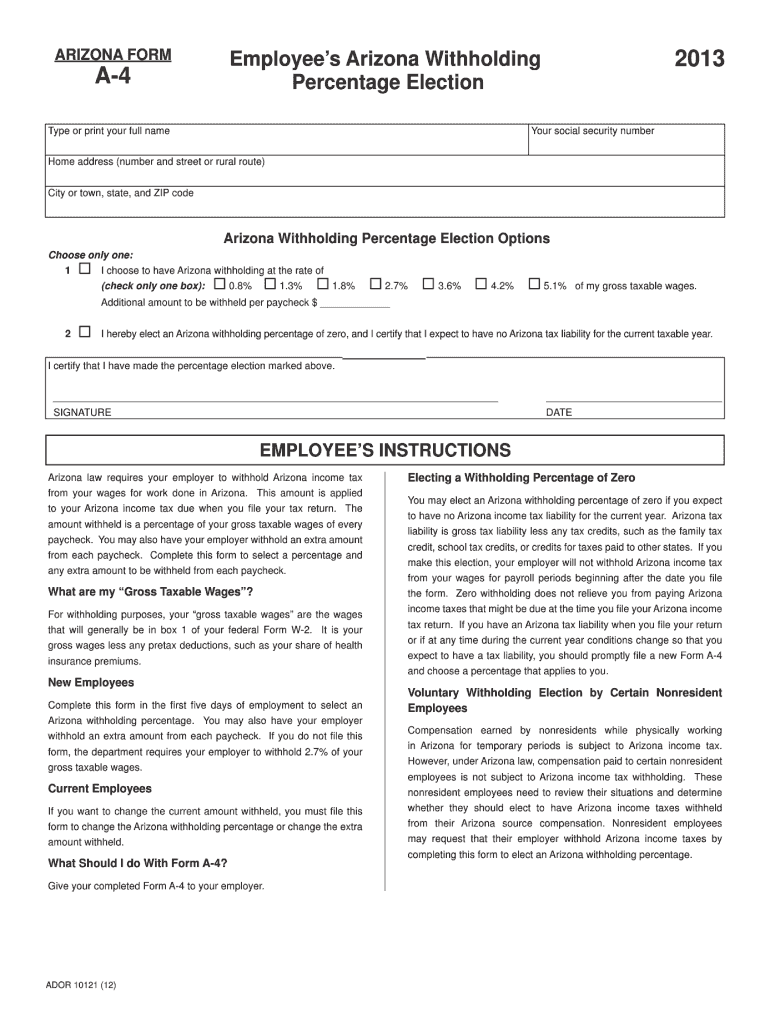

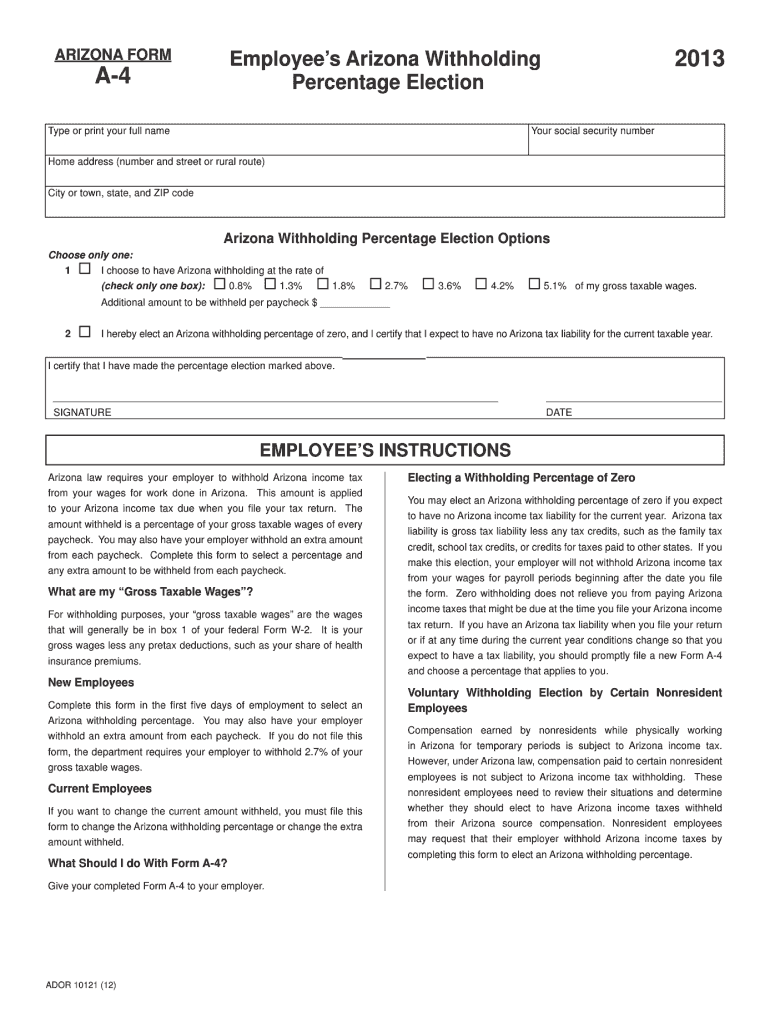

AZ DoR A-4 2013 free printable template

Get, Create, Make and Sign 2013 form a 4

How to edit 2013 form a 4 online

AZ DoR A-4 Form Versions

How to fill out 2013 form a 4

How to fill out AZ DoR A-4

Who needs AZ DoR A-4?

Instructions and Help about 2013 form a 4

Welcome back to our course on Access 2013. In this section we’re going to start to take a look at forms and forms are the primary means by which we allow users to interact with our database. During most of the course, so far we’ve been looking at tables and table design and entering data directly into the tables in that general spreadsheet style, the Data sheet View as we call it in Access. But that’s not really a good way to get users in general working with the data in a database. It’s far too dangerous. It doesn’t present the data in a way that’s easy for users to understand and generally speaking its asking for trouble really. So what we do is to provide forms and with those forms not only can we control what people are able to do with the database, but we can do many other things as well, such as perform calculations and checks in the background. We can fire those events which I mentioned earlier on whereby when we change a piece of data in one place, it causes something else to happen elsewhere in the database. So forms are a great way of both protecting the database and perhaps more importantly helping users to get the best out of the use of the database. Now as we’ll see there are a few ways of creating forms in Access 2013 and I want to start with a very simple case. What I’m going to do is to open the genre table, so just double click to open the genre table, and then I’m going to minimize the Navigation Pane, then I’m going to the Create Tab and then there’s a Forms Group. Now in the Forms Group there are really four ways, or four main ways I should say, of creating a form. There is this button, Form, where you create a form that lets you enter information for one record at a time. There’s form design which gives you a blank form and then lets you lay out the form in exactly the way that you want by adding controls to the form in exactly the positions you want. This one, blank form, which creates a form with no controls or formatting whatsoever and lets you start literally from scratch, and then there’s also a Form Wizard, and we’ll look at the Form Wizard a little later on. That’s a very helpful way of creating forms, but given that the way it does things may not quite agree with the way you like to do things. Sometimes the Form Wizard, although it looks as though it’s going to save you time, can actually take you longer to create forms and this probably particularly the case when you’ve been using Access for a while and created quite a few forms. Now the other on there, the navigation form, is very often a feature that you’ll use as what I would call the front end to the database. It’s the way that you control in the broadest sense what users are able to do in your database, and we’ll be looking at a navigation form much later on in the course. Now the drop-down here with more forms gives us access to modal dialogs, split forms, etc. and we’ll come back to a couple of those later on as well. The first thing I want to demonstrate is...

People Also Ask about

When was the W-4 form updated?

How do I fill out my w4 for 2022?

What is Arizona form a4?

Will there be a new w4 for 2022?

Is there a new W-4 form for 2022?

Has the w4 form changed?

How much should I withhold in Arizona a4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 2013 form a 4 in Gmail?

Can I edit 2013 form a 4 on an iOS device?

How do I complete 2013 form a 4 on an Android device?

What is AZ DoR A-4?

Who is required to file AZ DoR A-4?

How to fill out AZ DoR A-4?

What is the purpose of AZ DoR A-4?

What information must be reported on AZ DoR A-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.